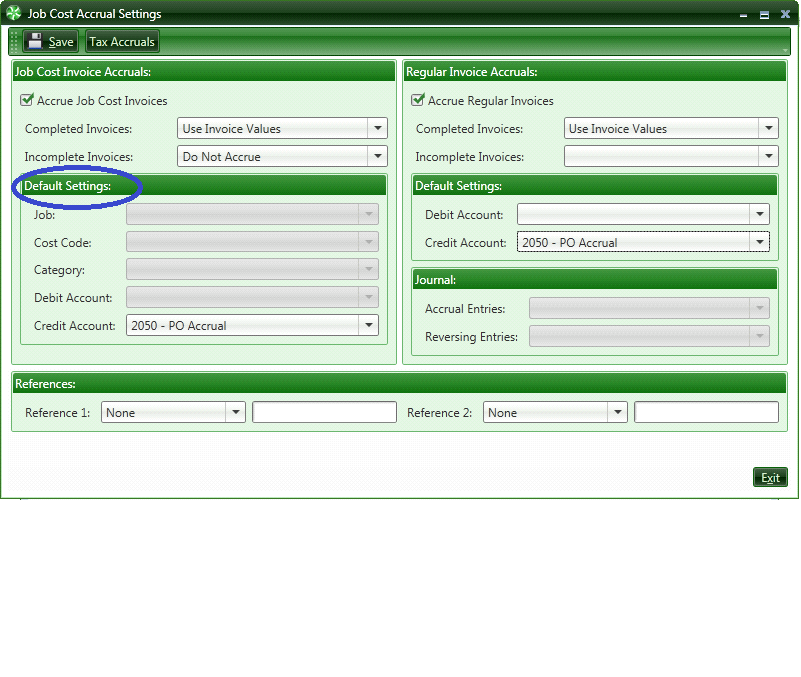

2.1.4.8.6.1. Accrual Settings

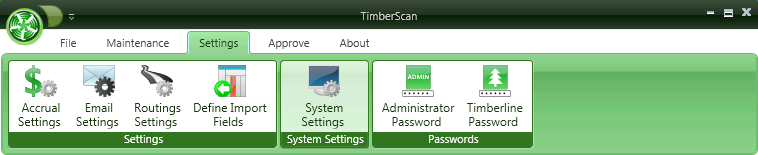

While signed in as Administrator,

Select Settings > Accrual Settings

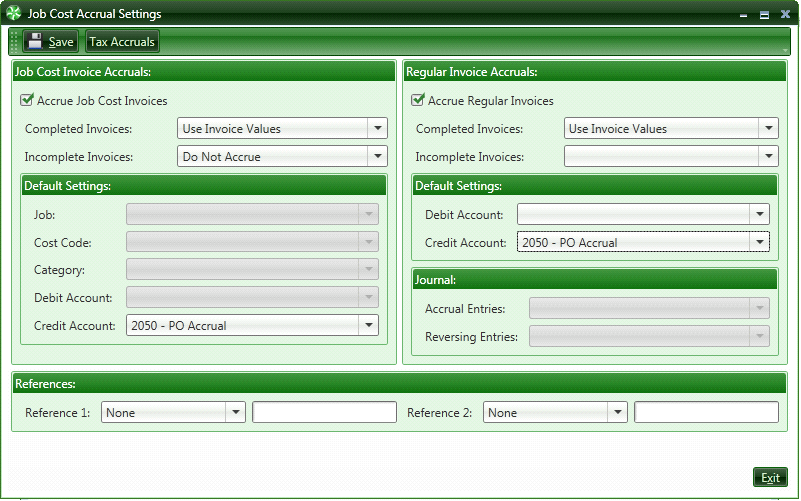

You can define the rules for accruing invoices.

Job Cost Accruals:

Select this if you need accruals to post to Sage 300 CRE's Job Cost Module.

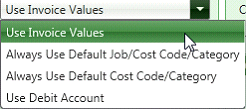

Completed Invoices: The default is “Use Invoice Values” for Completed Invoices.

The other options are:

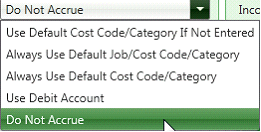

Incomplete Invoices: The default for Incomplete Invoices is “Do Not Accrue”.

The other options are:

If you Decide NOT to use the invoice values you can use Default Values for the Job Cost fields and/or General Ledger accounts.

Default Settings for Job Cost Accruals

You must enter an Credit Account (Probably an Accrual Account)

Regular Invoice Accruals

These are invoices without Job Cost information. You can elect to accrue or not to accrue.

The Regular Account Accruals allow you to use the Invoice Values for posting to G/L or default values.

You will have to choose a credit account regardless how you choose to accrue the invoice amounts or debits.

Accrual Entries/Reversing Entries: If you are using Named Files you can choose which file names to use.

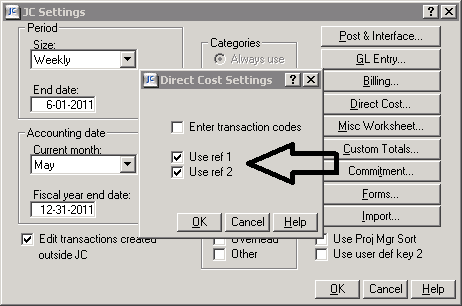

If you select to use Reference 1 and Reference 2, make sure you have Use Ref 1 and Ref 2 checked in Sage 300 CRE Job Cost > Job Cost Settings > Direct Cost.

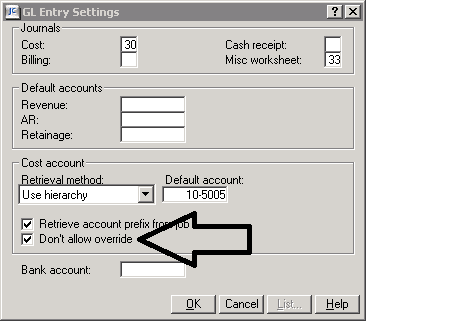

Also, in Job Cost Settings > GL Entry, the Don’t Allow Override option must be unchecked.

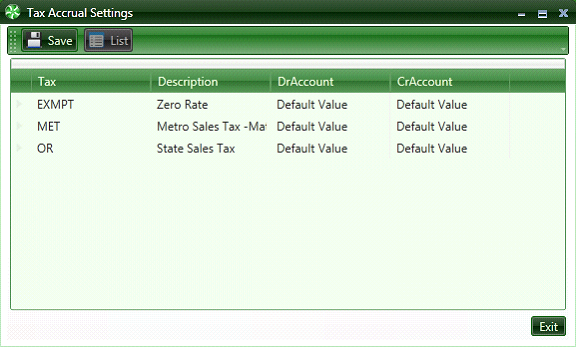

Tax Accrual settings allow you to override the accounts that the tax accruals post to

Tax Accrual settings allow you to override the accounts (Default Values) that the tax accruals post to.